Step into the dynamic world of decentralized finance (DeFi) with our comprehensive guide to swaps! Learn how to leverage the power of liquidity pools, understand the intricacies of AMMs (Automated Market Makers), and discover the best practices for securely executing your DeFi swaps. Whether you're a seasoned trader or just new to this exciting space, our guide will equip you with the knowledge you need in the ever-evolving landscape of DeFi.

- Explore the fundamentals of decentralized exchanges (DEXs) and their role in the DeFi ecosystem.

- Unpack the mechanics of AMMs, featuring popular protocols like copyright and SushiSwap.

- Compare different swap strategies to optimize your trading efficiency

- Master insights into risk management and best practices for secure DeFi swapping.

Join us as we unlock the potential of liquidity and empower you to confidently navigate the world of DeFi swaps!

Prime DeFi Swaps for Seamless copyright Trading

Navigating the dynamic world of copyright exchanging can be a complex process, but DeFi swaps offer a route to frictionless transactions. These decentralized platforms permit users to swap copyright assets directly, removing the need for centralized intermediaries.

- Let's some of the most popular DeFi swaps known for their quickness and robustness:

Curve Finance is a decentralized exchange that facilitates users to trade a wide range of tokens with low fees. Its easy-to-use interface makes it accessible even for those just starting out.

PancakeSwap is another popular DeFi swap that distinguishes itself with its algorithmic trading systems. These pools allow for automatic price discovery and lower slippage, making it a reliable option for traders.

Decentralized Finance Revolution: Mastering the Art of DeFi Swaps

The emerging world of Decentralized Finance presents a paradigm shift in traditional finance. At its core, DeFi enables direct transactions without intermediaries, fostering accountability. Among the most popular applications within DeFi are swaps. A DeFi swap allows users to convert one copyright for another in a safe and rapid manner. Harnessing smart contracts, these platforms facilitate seamless swaps, removing the need for traditional exchanges.

- Understanding the mechanics of DeFi swaps is crucial for navigating this transformative financial landscape.

- Diverse factors influence swap prices, including market demand, liquidity, and basic asset values.

- Before engaging in DeFi swaps, it's essential to conduct thorough research and understand the associated volatility.

Mastering the art of DeFi swaps requires a blend of technical knowledge and tactical thinking. By adopting best practices, users can enhance their profits while mitigating potential downsides.

DeFi Swaps: Going Beyond copyright in 2023

copyright remains a dominant force in the DeFi sphere, but the copyright world is always evolving. A plethora of innovative DeFi exchanges are vying for attention, each with its unique advantages. Whether you're seeking lower slippage or a more specialized trading experience, there's a swap out there that might be better suited for your needs.

- Some platforms, like SushiSwap and Curve Finance, focus on specific assets, offering optimized trading pairs.

- Conversely, decentralized exchanges like PancakeSwap and DodoEX provide access to a wider range of digital assets often with lower fees.

In this exploration, we'll delve into some of the most promising DeFi swaps beyond copyright, examining their strengths and weaknesses to help you make an savvy choice.

Navigate the DeFi Landscape: A Comprehensive Look at Top Swaps

The decentralized finance (DeFi) ecosystem is rapidly expanding, offering a extensive range of financial services built on blockchain technology. One fundamental aspect of DeFi is swapping cryptocurrencies, allowing users to seamlessly exchange tokens between different blockchains or within the same network. Navigating this landscape can be complex, but several top swaps stand out as reliable and accessible platforms.

- Prominent swaps like copyright, SushiSwap, and PancakeSwap offer high liquidity and favorable fees, making them ideal for both small and large trades.

- Other platforms, such as Curve Finance and Balancer, focus to specific asset classes or trading strategies, providing advanced features for experienced traders.

Prior to the world of DeFi swaps, it's essential to perform thorough research, understanding the risks and rewards involved.

Navigating the Financial Landscape: Utilizing DeFi Swaps to Generate Profits

The decentralized finance ecosystem, or DeFi, is rapidly evolving, providing a abundance of innovative opportunities for savvy investors. Among these, DeFi swaps stand out as a particularly powerful tool for generating profits. These exchanges allow users to seamlessly exchange cryptocurrencies without the need for central authorities. This reduces fees and improves the trading experience, making DeFi swaps an attractive proposition for both novice and experienced traders.

Additionally, the autonomous nature of DeFi swaps promotes transparency and security. Transactions are recorded on a public blockchain, making them permanent. This cultivates trust and eliminates the risk of fraud, creating a robust trading environment.

As DeFi continues to mature, we can expect even more sophisticated swap protocols that provide enhanced efficiency. Early investors who embrace these technologies stand to realize significant returns in the years to come.

Judd Nelson Then & Now!

Judd Nelson Then & Now! Ashley Johnson Then & Now!

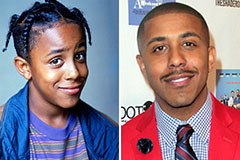

Ashley Johnson Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Shane West Then & Now!

Shane West Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now!